Debtors

As a debtor, you may access data and information related to your debts owed to any CCR reporting creditor, whenever you wish and free of charge. You may also request the rectification and/or completion of these data.

The processing of personal data included in Credit Reports is carried out lawfully pursuant to Law 4972/2022 and in full compliance with the General Data Protection Regulation (GDPR).Information regarding the exercise of data subjects’ rights under the General Data Protection Regulation (GDPR) and the applicable national legislation is available at the following link.

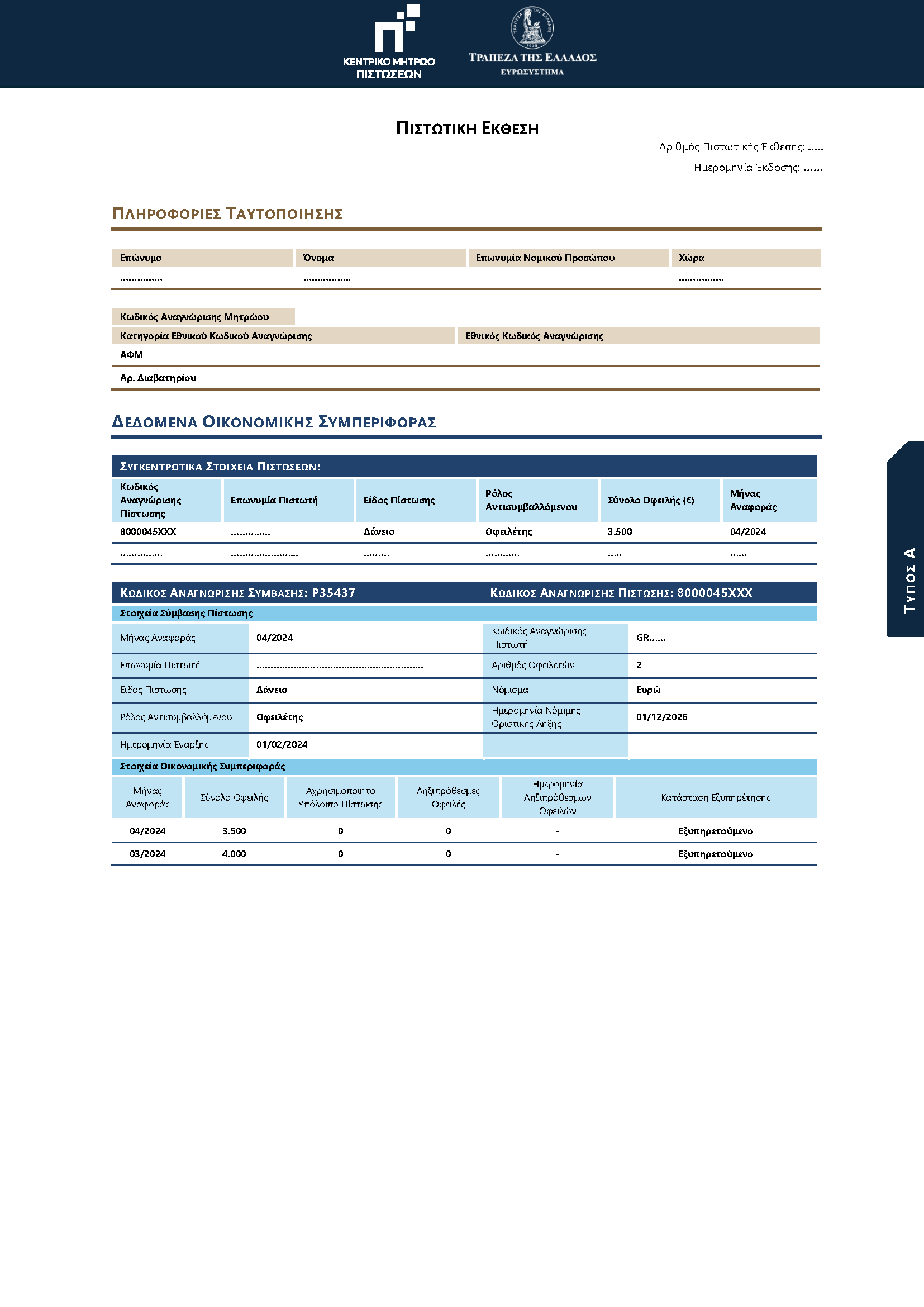

Credit report (Type A)

Contents

A Type A credit report contains a set of data identifying you as a debtor, as well as data reflecting your credit status over the last twelve (12) months.

All data contained in the credit report are extracted from the analytical database of the CCR and derive from the monthly reporting of creditors to the CCR and to GR-AnaCredit, following the cross-checking of identification information and general information drawn from State entities, such as the IAPR, the G.E.MI. and the DYPA information system.

You may request and obtain online a Type A credit report after you have been successfully identified in the Classified Environment of the CCR Portal (CCRP), following the procedure described below.

For further information, please refer to the Operation Manual of the CCR.

Log in to the classified environment of the CCR Portal using your TAXISnet credentials (of a natural or legal person). If you are a natural person, in order to be able to log in successfully, you should first register your updated contact details in the National Communication Register.

Fill in and submit the online application form for the issuance of a credit report.

The credit report is issued automatically within 24 hours after submission of the relevant application and is available for download in the section “My credit reports”.

Contestation request

What does it concern?

As a debtor, you have the right to contest, rectify and complete the data contained in the credit report by submitting a relevant online request.

The submission of the contestation request serves the purpose of:

- Rectifying inaccurate data contained in the credit report.

- Completing incomplete data not contained in the credit Report.

Each request for rectification and/or completion of credit information is addressed to one creditor only, whom the debtor designates and to whom the request is automatically forwarded after its submission for checking and for possible rectifying actions.

Creditors that receive a contestation request are obliged to respond in writing to the Bank of Greece in order for the latter to reply to the debtor who submitted the request, no later than 30 days from its submission. If the Creditor does not intend to comply, they must provide justification for this decision in their reply.

Creditors are solely responsible for the validity, completeness and accuracy of the credit information reported in the CCR, which is then displayed in the credit reports.

Log in to the classified environment of the CCR Portal using your TAXISnet credentials (of a natural or legal person). If you are a natural person, in order to be able to log in successfully, you should first register your updated contact details in the National Communication Register.

Fill in and submit the online data contestation request form.

How to obtain access

Natural persons/Sole proprietorships

Legal persons

Log in to use the services of the CCR

As a debtor, what rights do I have in the CCR?

As a debtor, you have the following rights in the CCR:

• You may access data on your debts owed to any CCR reporting creditor by obtaining a Type A credit report.

• You may contest the data of the credit report in order to (a) have inaccurate data rectified or (b) have incomplete data completed.

• The confidentiality and security of your personal data is ensured in accordance with the applicable personal data protection institutional framework.

Who has access to my data and for what purposes?

Access to your data is reserved to the Bank of Greece and the European Central Bank, to any creditor to whom you owe a debt or to whom you have submitted a credit application, as well as to the competent public authorities under Article 117(1) of Law 4972/2022.

How is the protection of my personal data ensured?

Personal data protection relies on the use of special encryption and secure access protocols, which ensure compliance with the General Data Protection Regulation (GDPR) and national legislation on data protection. Learn more here.

The processing of personal data in Credit Reports is carried out lawfully pursuant to Law 4972/2022 and in accordance with the General Data Protection Regulation (GDPR). Information regarding data subjects’ rights under the General Data Protection Regulation (GDPR) and the applicable national legislation may be obtained by accessing the following link.

What kind of data concerning me can creditors access?

Creditors can access data relating to loans, leasing contracts, factoring contracts, as well as the collateral provided for them. Granular data contained in the credit report, to which creditors have access, are described in the relevant Bank of Greece Governor’s Acts. Governor’s Acts Nos. 2692/30.06.2023, 2697/11.12.2025 and 2698/12.12.2025.

Who is responsible for the accuracy of my data?

Creditors that provide data to the CCR are responsible for data accuracy. In addition, the Bank of Greece cross-checks your identification information with the information systems of the IAPR, the G.E.MI. and ERGANI or with any other competent government entity, in accordance with Article 7 of Governor’s Act No. 2697/11.12.2025.

What can I do if the credit report contains inaccurate data?

You may submit an online contestation request through the CCR Portal for the rectification of inaccurate data or the completion of incomplete data concerning you. Contestation request

Who is responsible for rectifying my data after the submission of a contestation request?

The agent responsible for data rectification is the creditor that provided the initial data, which are being challenged. The creditor must check and correct the data in line with the contestation request and respond in writing to the Bank of Greece in order for the latter to reply to the debtor who submitted the request, no later than 30 days from its submission. If the Creditor does not intend to comply, they must provide justification for this decision in their reply.

Is it possible to submit a contestation request addressed to more than one creditor?

According to the procedure, a contestation request that concerns credit information may be addressed to one creditor only. If you wish to contest data related to more creditors, you need to submit additional contestation requests to each one of them.

Is there a charge for obtaining a credit report or for submitting a data contestation request?

Debtors can obtain a credit report or submit a data contestation request free of charge.

I do not recognise the name of the creditor regarding one of my debts. What could be the reason for this?

This could happen due to a change in the creditor’s company name or to the transfer of your debt to another creditor. You are advised to submit a contestation request in order to clarify the issue.

Does the CCR collect data even on debts/loans that I repay on time?

The CCR collects data on all types of credit that fall under the reporting requirements of the CCR, in accordance with Article 4 of Bank of Greece Governor’s Act No. 2697/11.12.2025, regardless of late payments.

What happens if I repay a loan in full or if the total loan amount due falls below the credit threshold on data reporting set by the CCR?

If a loan is fully repaid or if your total loan amount due per creditor falls below the credit threshold on data reporting set by the CCR, then the data related to such loan/loans will no longer appear in the credit report.

May I request access to data concerning third parties on their behalf?

Access to third-party data may be granted only if a legal basis is provided for that.

How can I correct my identification information?

The identification and general information concerning debtors, included in the Credit Reports, are cross-checked and verified against the data maintained in the information systems of the Independent Authority for Public Revenue (IAPR).

If you wish to correct this information, please submit a relevant request to the IAPR.