Are you a creditor?

As a creditor, you may access CCR data, providing you with comprehensive information about the credit status of debtors with whom you have signed or are about to sign a credit agreement.

Meanwhile, you are required to connect to the CCR and proceed to the monthly reporting of identification and credit information, as laid down in the Institutional Framework that governs the CCR.

Credit report (Type B)

A Type B credit report reflects the overall credit overview of the latest available reporting month in the CCR, referring exclusively to debtors with whom you have signed an agreement and on whom you have reported data to the CCR, including credit granted to the same debtors but reported by other creditors.

The processing of personal data in a Type B Credit Report is carried out lawfully pursuant to Law 4972/2022 and in accordance with the General Data Protection Regulation (GDPR).

All data contained in the report are extracted from the analytical database of the CCR and derive from the monthly reporting of creditors to the CCR and to GR-AnaCredit, as well as from the cross-checking of data drawn from government entities, such as the IAPR, the G.E.MI. and the DYPA information system.

You can obtain a Type B credit report online through the Internet Reporting Information System (IRIS) of the Bank of Greece.

For further information, please refer to the Operation Manual of the CCR.

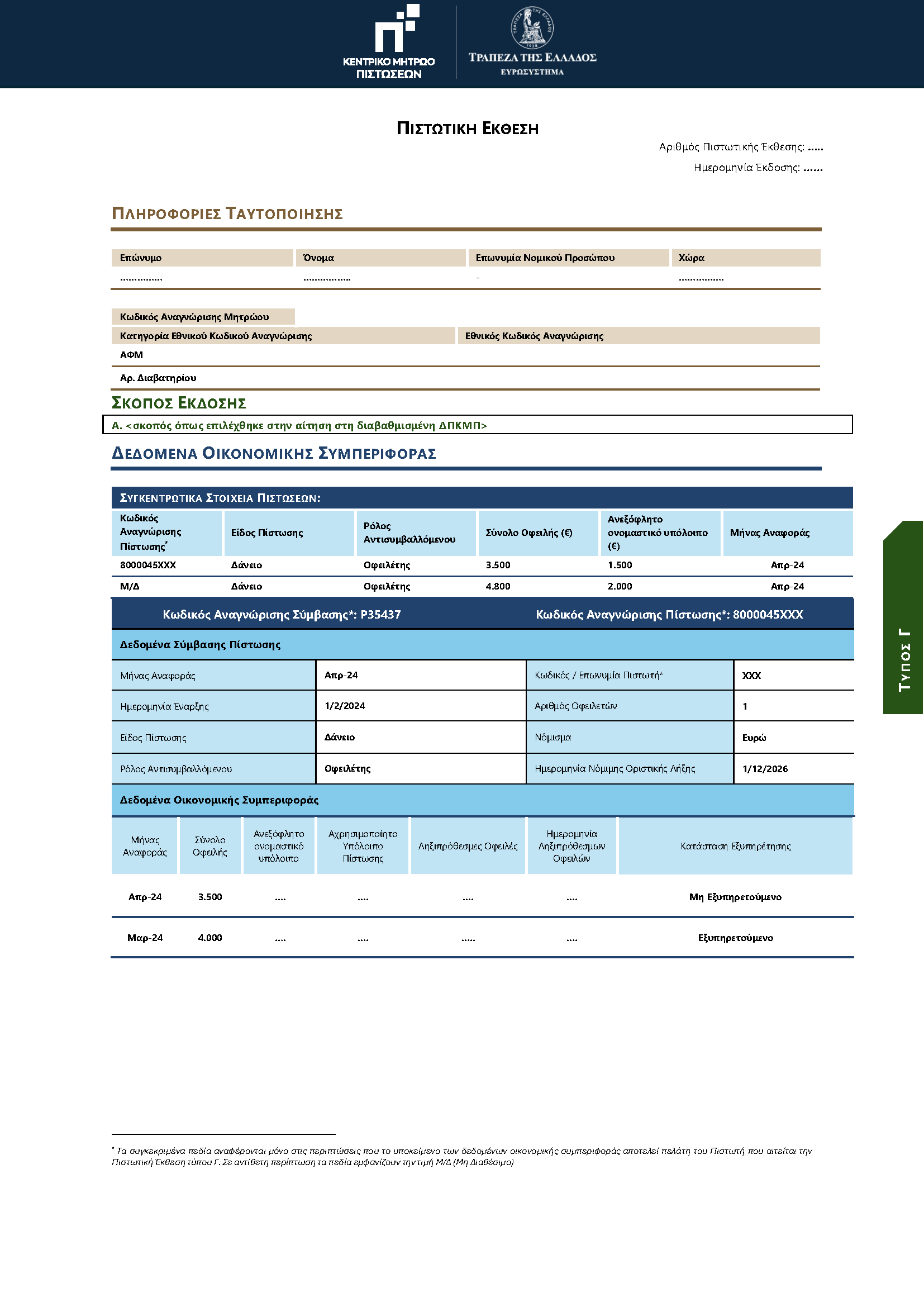

Credit report (Type C)

Contents

A Type C credit report contains a set of identification and verification information on a specific debtor, as well as data reported to the CCR that reflect his/her credit performance over the last twelve (12) months.

All data contained in the report are extracted from the analytical database of the CCR and derive from the monthly reporting of creditors to the CCR and to GR-AnaCredit, following the cross-checking of data drawn from government entities, such as the IAPR, the G.E.MI. and the DYPA information system.

You may request and obtain online a Type C credit report about a debtor, after successfully logging in in the classified environment of the CCR Portal, in line with the procedure described below.

For further information, please refer to the Operation Manual of the CCR.

for one of the following purposes:

- Verification of information

- Assessment of risks related to the granting of credit or the acceptance of provided guarantee

- Monitoring and assessment of failure to comply with the terms and conditions of a credit or guarantee agreement

- Evaluation of a debtor’s application for a debt settlement plan

- Analysis of credit agreement portfolios

As a creditor’s authorised representative, log in to the classified environment of the CCR Portal, using your IRIS account.

Fill in and submit the online application form for the issuance of a credit report about a data subject.

The credit report is issued automatically within 24 hours after submission of the relevant application and is available for download in the section “My credit reports”.

How to obtain access

Creditors’ representatives

Log in to use the services of the CCR

As a creditor, which CCR data and services do I have the right to access?

As a creditor, you have the right to access granular credit data, the payment history, the collateral provided and other relevant information on debtors with a potential total credit amount (per creditor and debtor) equal to or greater than EUR 2,000 for natural persons and sole proprietorships and EUR 5,000 for legal persons.

How can I obtain access to the CCR?

You can obtain access to the CCR through the classified environment of the CCR Portal (CCRP). The handling of data exchanged through the CCRP is subject to strict security measures, which ensure the confidentiality and integrity of information.

For which purposes may I request access to CCR data?

You may request access to CCR data for several purposes such as the following:

- Verification of information: Assessment of the accuracy of information provided by the debtor when submitting a credit application.

- Risk assessment: Evaluation of the risks associated with the granting of credit or the acceptance of guarantees.

- Monitoring and assessment of agreements: Monitoring and assessment of compliance with the terms and conditions of credit or Guarantee agreements.

- Debt settlement plan: Evaluation of debtors’ applications for a debt settlement plan.

- Portfolio analysis: Analysis and evaluation of the creditor’s credit agreement portfolio, as well as credit risk assessment.

The purposes are regulated by the legislation currently in force and provide a legal basis for granting creditors access to CCR data, subject to the necessary justification and the purpose specified.

By submitting the necessary data to the CCR, do I also fulfil my GR-AnaCredit reporting obligations?

AnaCredit reporting requirements under Bank of Greece Governor’s Act No. 2677/19.05.2017, as amended by Governor’s Act No. 2692/30.06.2023, remain independent from reporting requirements in the context of the CCR. However, information that is reported in the context of GR-AnaCredit does not need and is not expected to be reported also in the context of the CCR. The integrated information system of the CCR has the capacity to retrieve and incorporate all data reported to GR-AnaCredit.